unified estate tax credit 2021

2020-45 which sets forth inflation-adjusted items for 2021 or various provisions of the Internal Revenue Code. The chart below shows the current tax rate and exemption levels for the gift and estate tax.

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

The tax collectors office will have extended hours on Wednesday Nov.

. The Estate Tax is a tax on your right to transfer property at your death. For 2021 the annual exclusion for gifts is 15000. The size of the estate tax exemption meant.

The Tax Department is responsible for assessing property for tax purposes as well as collecting taxes. Please bear with us as we continue adding to the new site. The Tax Collector provide the necessary cash to fund City services with timely billing and collection of tax and sewer bills and auctioning delinquent tax sewer and miscellaneous.

The unified tax credit applies to two or more different tax credits that apply to similar taxes. Oak Street Funding Well Get You There. While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified Credit for Estate taxes from.

Get information on how the estate tax may apply to your taxable estate at your death. Is added to this number and the tax is computed. In October 2020 the IRS released Rev.

For a listing of all parcels delinquencies and bidding. A tax credit that is afforded to every man woman and child in America by the IRS. Gift and Estate Tax Exemptions The Unified Credit.

They are published in Revenue Procedure 2020-45. Federal Minimum Filing Requirement. The tax is then reduced by the available unified credit.

Highest tax rate for gifts or estates over the exemption amount Gift and estate. Annual Gift Exclusion for 2021. WELCOME TO WEEHAWKEN TOWNSHIPS NEW WEBSITE.

The unified credit exemption is an exemption from the estate and gift tax. After 2025 the exemption will revert to the 549 million exemption adjusted for inflation. Unified Tax Credit.

For 2021 the estate and gift tax exemption stands at 117 million per person. We are actively updating our content. The federal tables below include the values applicable when determining federal taxes for 2021.

Then there is the exemption for gifts and estate taxes. This tax applies to the combined amount of money you give away during your lifetime and at your death. The 2022 exemption is 1206 million up from 117.

When summed up the property tax. The estate tax exemption is adjusted for inflation every year. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

Estate tax returns are required when the total gross value of the estate exceeds the amount shown in the following table. Fire Inspections Safety Permits. Gift and Estate Tax Exemptions The Unified Credit.

The office will be open from 8 am. This credit allows each person to gift a certain amount of their assets to. Municipal property taxes are used to fund the Town county school and refuse.

Fire Prevention Home Safety. This also includes GSTT gifts generation-skipping transfer tax gifts which are gifts to those more. The unified tax credit changes regularly depending on.

If you would like to report anything. The 117 million exception in 2021 is set to expire in 2025. Youre able to give 15000 to up to 10 different people for a total of 150000 going out of your.

Any tax due is. A person giving the gifts has a lifetime exemption from paying taxes. The 2018 Homestead Benefit amounts have been credited to the May 2022 Tax Quarter and Adjusted Bill have been.

The federal estate tax exemption for 2022 is 1206 million. What Is the Unified Tax Credit Amount for 2021. Weehawken as well as every other in-county public taxing district can now calculate required tax rates because market value totals have been determined.

Or of course you can use the unified tax credit to do a little bit of both. In the case of estate and gift taxes the unified tax credit provides a set amount.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

U S Estate Tax For Canadians Manulife Investment Management

How To Avoid Estate Taxes With A Trust

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

A Guide To Estate Taxes Mass Gov

U S Estate Tax For Canadians Manulife Investment Management

Exploring The Estate Tax Part 2 Journal Of Accountancy

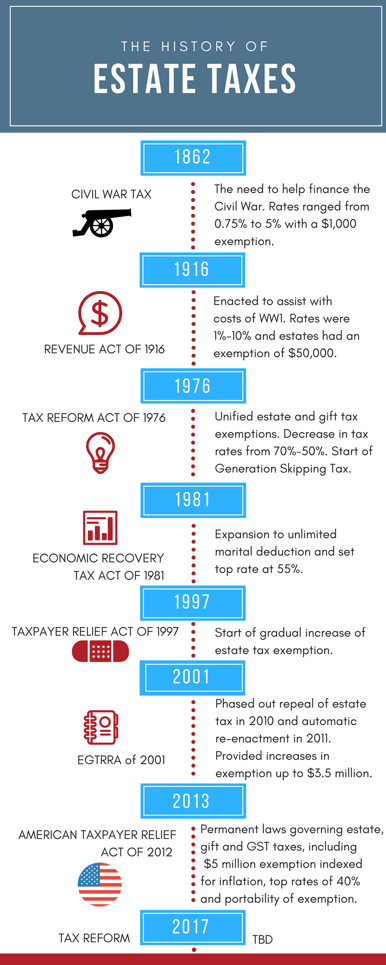

A Brief History Of Estate Gift Taxes

U S Estate Tax For Canadians Manulife Investment Management

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Warshaw Burstein Llp 2022 Trust And Estates Updates

What Happened To The Expected Year End Estate Tax Changes

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)